Gaming Intelligence presents the US iGaming Slot Intel Report from Product Radars for the week ended November 1st, ranking the most popular games across the regulated US iGaming markets.

✨ New in this week’s Product Radars’ US market report

It was Michigan last week. Now this week we’ve added some new analysis we hope you’ll like:

🎯 Top Game Families – now live!

Game Families have become one of the biggest forces in the US market, driving a huge share of player engagement. We now track more than 140 game families, and this week’s report debuts our new Top Ten Game Families Tracker, highlighting which series are really dominating operator homepages week-to-week.

🤝 Studio & Operator Affinities – out from the lab

Ever wondered which studios and operators are most tightly aligned? Our new Affinity Score explores exactly that – measuring the strength and duration of those relationships, how long exclusives last, and how these partnerships shape visibility across the market.

Reporting Period: 26/10/2025 – 01/11/2025

We look at the Content Positioning of games on the main lobby pages as the best public indication of game performance. This is NOT a direct measurement of GGR.

Where studios have more than one studio brand we collapse all of those numbers under the main studio. For example Light & Wonder statistics contains all Elk and Lightning Box games.

Each state’s results are based on performance within that state only, showing how studios and games perform within that state’s market. To make cross-state comparisons meaningful, our Regional Adjusted scores apply a weighting factor based on each state’s published or estimated iGaming Gross Gaming Revenue.

This ensures that a game or studio’s influence in a larger market (such as New Jersey) carries proportionally more weight in the overall US picture than performance in a smaller market and allows us to analyse and compare game performance across all of the states we monitor.

Here are this week’s key highlights:

🏆 Games Global take the top spot — 12 Fortune Dragons, Wolf Prime Deluxe, and Gold Blitz Ultimate drive a strong all-round performance, with six of the top ten Game Families now carrying their name.

🐷 Light & Wonder hold close in second — the Huff n’ Puff family continues its dominant run, with Money Mansion launching exclusively on FanDuel this week.

💎 IGT stays right in the mix — Wheel of Fortune Diamond Spins 2X Wilds is crowned Best New Launch of the Week, keeping the iconic brand front and centre across US lobbies.

🔥 Konami and Bragg impress — Ba Fang Jin Bao Abundant Fortune and Paddy O’Plunder 2 debut strongly across Caesars and FanDuel, signalling healthy competition in mid-tier launches.

| Unique Games: 683 | Unique Studios: 75 | Unique Titles: 6,894 | Game Launches: 36 |

| Unique games detected in last week | Unique studios detected in last week | Unique games detected in last week | New game launched detected in last week |

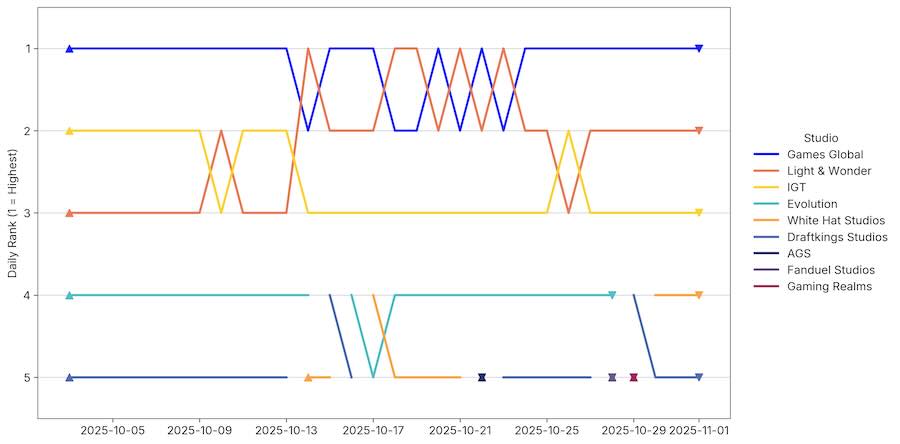

Daily Studio Rankings – All States

In the latest iGaming Weekly Studio Ranking Summary for the US region, the competitive landscape remains dynamic, with notable shifts in positions among the top five studios.

- Games Global retains its position at first place, bolstered by strong performances from titles like 12 Fortune Dragons. Wolf Prime Deluxe saw significant gains. Whilst they don’t have a single killer game family to the same level as L&W and IGT (Gold Blitz is pretty strong) you can get a real sense of their depth in our new Game Family table where they hold 6 of the top 10 places. Impressive.

- Light & Wonder holds steady at second place, despite a slight dip in overall score. The Huff n’ Puff family continues to drive their success so all eyes on the 4th game in that franchise, Huff n’ Puff Money Mansion, launching this week exclusively with FanDuel brands. We’re trying to get you some deeper insights into these tight operator/studio relationships and the exclusive launch windows so check out our new Studio and Operator Affinities section at the bottom

- IGT remains in third place, close behind our leaders, trading places with L&W throughout the week. Wheel Of Fortune Diamond Spins 2X Wilds has contributed positively, and is our best new game launch of the week.

- White Hat Studios continues to make inroads, with a decent showing from Kong 3 Even Bigger Bonus.

Ones to watch:

- Bragg (under their Atomic Slots Lab label) gets a good launch with Paddy O’Plunder 2. One to watch next week.

- Sleeping giant Aristocrat are rumbling. Pompeii showing signs of erupting, and Buffalo and Friends getting some action too. Renewed management focus on iGaming?

- The Slingo games from Gaming Realms keep popping up, with collaborations and branding tie-ups. Great games and a strong niche in the market.

- Shouts out to RubyPlay and Spinomenal who appear in our Studio and Operator Affinities section of the report for their strong relationships with FanDuel and Caesars respectively.

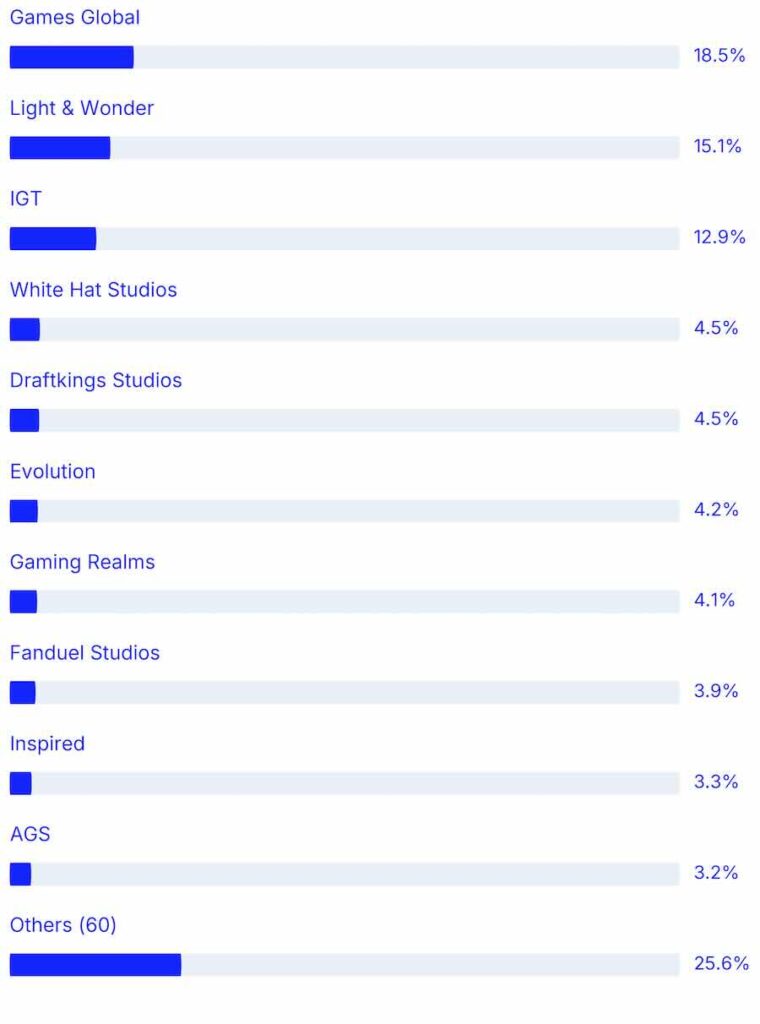

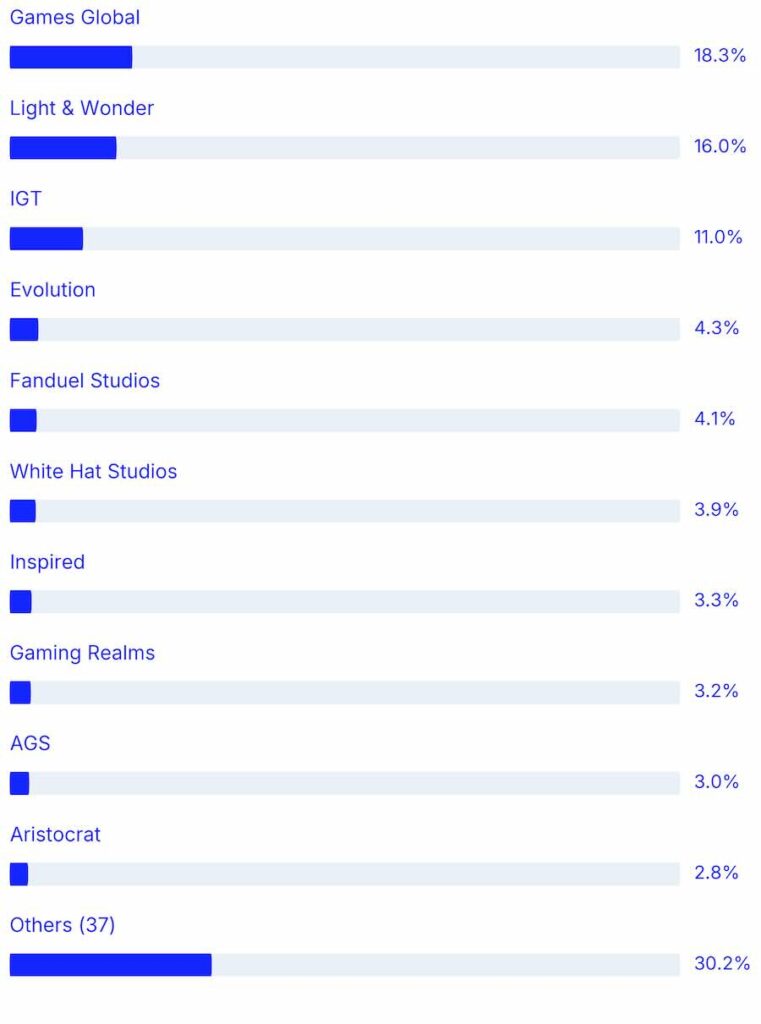

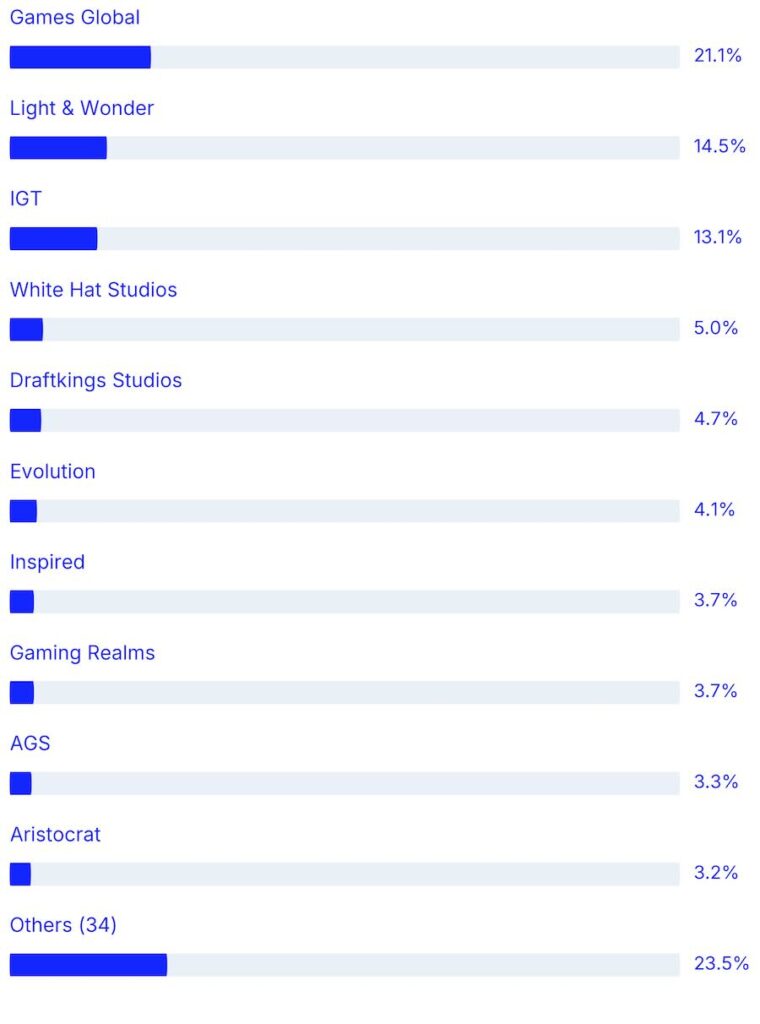

Studio Weekly Share

This chart shows the share a studio has of game positions. The algorithm accounts for the position of the game on each page, giving a higher share value to games on the top left and games in featured game slots. It also accounts for published and estimated GGR share each operator has in a state, so a game top left on a site like DraftKings in New Jersey will score highly.

Studio Weekly Share – By State

Connecticut

Michigan

New Jersey

Pennsylvania

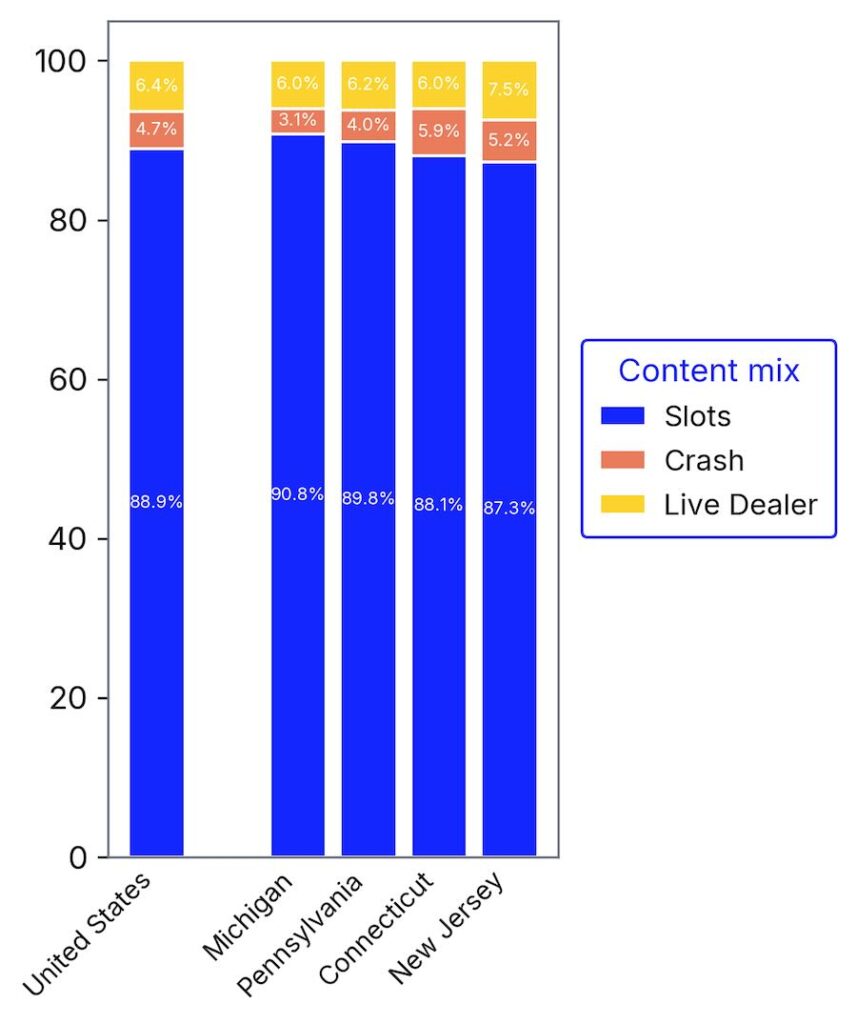

Content Type Positioning Split

This chart shows the content positioning share between Crash Games, Slots and Live Dealer across the US and per tracked state. This is not the same as GGR split. We estimate that Live Dealer and Crash Game GGR share is substantially higher than shown here in GGR.

Top 20 Games – All States

| Rank | Game Name | Studio | Region-Weighted Score (US) | Unique Brands |

| 1 | Huff n Lots Of Puff | Light & Wonder | 796 | 12 |

| 2 | Cash Eruption | IGT | 769 | 17 |

| 3 | Huff n Even More Puff | Light & Wonder | 385 | 18 |

| 4 | Huff n More Puff | Light & Wonder | 361 | 17 |

| 5 | 12 Fortune Dragons | Light & Wonder | 325 | 4 |

| 6 | Rocket | DraftKings Studios | 285 | 5 |

| 7 | FlyX Party | Games Global | 268 | 4 |

| 8 | Big Bank Breakout Cash Eruption | IGT | 260 | 4 |

| 9 | Devil Cash Uncovered | Games Global | 247 | 10 |

| 10 | Jewel Boom Super Drop | Atlantic Digital | 245 | 4 |

| 11 | NBA Super Slam | FanDuel Studios | 243 | 4 |

| 12 | Wolf It Up! Again | Inspired | 239 | 5 |

| 13 | The Wizard Of Oz Munchkinland | Light & Wonder | 209 | 4 |

| 14 | House Of Spins | Games Global | 208 | 4 |

| 15 | Enchanted Wolf: Rising Rewards | Games Global | 205 | 15 |

| 16 | Football Blackjack | FanDuel Studios | 196 | 5 |

| 17 | Gold Blitz Ultimate | Games Global | 196 | 5 |

| 18 | Rocket 2 | DraftKings Studios | 186 | 4 |

| 19 | BetMGM Fortune Vault | BetMGM Studios | 183 | 4 |

| 20 | Wolf Prime Deluxe | Games Global | 173 | 3 |

Top 5 Games — By State

Connecticut

| Rank | Game Name | Studio | Score | Unique Brands |

| 1 | Cash Eruption | IGT | 1,728 | 2 |

| 2 | Huff n More Puff | Light & Wonder | 1,590 | 2 |

| 3 | Huff n Even More Puff | Light & Wonder | 1,346 | 2 |

| 4 | NBA Super Slam | FanDuel Studios | 913 | 1 |

| 5 | Hypernova Megaways | Reelplay | 880 | 1 |

Michigan

| Rank | Game Name | Studio | Score | Unique Brands |

| 1 | Huff n Lots Of Puff | Light & Wonder | 684 | 1 |

| 2 | Cash Eruption | IGT | 647 | 4 |

| 3 | Huff n Even More Puff | Light & Wonder | 535 | 6 |

| 4 | 12 Fortune Dragons | Games Global | 391 | 1 |

| 5 | FlyX Party | Games Global | 371 | 1 |

New Jersey

| Rank | Game Name | Studio | Score | Unique Brands |

| 1 | Huff n Lots Of Puff | Light & Wonder | 1,003 | 4 |

| 2 | Cash Eruption | IGT | 786 | 5 |

| 3 | 12 Fortune Dragons | Games Global | 364 | 2 |

| 4 | Jewel Boom Super Drop | Atlantic Digital | 330 | 2 |

| 5 | Mystery Of The Lamp Treasure Oasis | IGT | 323 | 1 |

Pennsylvania

| Rank | Game Name | Studio | Score | Unique Brands |

| 1 | Huff n Lots Of Puff | Light & Wonder | 704 | 5 |

| 2 | Cash Eruption | IGT | 661 | 6 |

| 3 | Zeus Gold Blitz Fortune Tower | Games Global | 336 | 2 |

| 4 | 12 Fortune Dragons | Games Global | 304 | 1 |

| 5 | Rocket | DraftKings Studios | 298 | 1 |

Top Game Families

NEW: This table shows the performance of the top game families across the US.

| Rank | Family | Studio | Family Size | Live Titles | Total Score | Top Title |

| 1 | Huff n Puff Series | Light & Wonder | 3 | 3 | 1,542 | Huff n Lots Of Puff |

| 2 | Cash Eruption Series | IGT | 11 | 5 | 1,144 | Cash Eruption |

| 3 | Gold Blitz Series | Games Global | 24 | 8 | 868 | Gold Blitz Ultimate |

| 4 | Slingo Series | Gaming Realms | 41 | 11 | 706 | Slingo Cash Eruption |

| 5 | Rakin’ Bacon Series | AGS | 6 | 4 | 373 | Rakin Bacon Jackpots Bonus Wheel |

| 6 | FlyX Series | Games Global | 5 | 2 | 369 | FlyX Party |

| 7 | Cash Uncovered Series | Games Global | 3 | 1 | 247 | Devil Cash Uncovered |

| 8 | Power Combo Series | Games Global | 28 | 4 | 235 | Triple Phoenix Power Combo |

| 9 | Rising Rewards Series | Games Global | 4 | 1 | 205 | Enchanted Wolf: Rising Rewards |

| 10 | Willy Wonka Series | Light & Wonder | 3 | 2 | 158 | Willy Wonka Dreamers Of Dreams |

Top Movers Up – All States

| Rank | Game Name | Studio | Region-Weighted Score Δ (US) | Brands |

| 1 | Wolf Prime Deluxe | Games Global | +53 | 3 |

| 2 | Huff n More Puff | Light & Wonder | +48 | 17 |

| 3 | Gold Blitz Fortunes | Games Global | +44 | 4 |

| 4 | 12 Fortune Dragons | Games Global | +40 | 4 |

| 5 | Cash Eruption | IGT | +37 | 17 |

| 6 | Wolf It Up! Again | Inspired | +33 | 5 |

| 7 | The Wizard Of Oz Follow The Yellow Brick Road | Light & Wonder | +29 | 3 |

| 8 | Huff n Lots Of Puff | Light & Wonder | +28 | 12 |

| 9 | Rocket | DraftKings Studios | +26 | 5 |

| 10 | Paddy 2 O Plunder | Atomic Slot Lab | +24 | 6 |

Top Movers Down – All States

| Rank | Game Name | Studio | Region-Weighted Score Δ (US) | Brands |

| 1 | Huff n Even More Puff | Light & Wonder | -21 | 18 |

| 2 | Breaking Bad Mega Fire Blaze | Playtech | -19 | 3 |

| 3 | 5 Flaming Dollars | 4 The Player | -16 | 3 |

| 4 | Wolf Stacks Megaways | Evolution | -15 | 5 |

| 5 | Cash Eruption Mega Jackpots | IGT | -15 | 2 |

| 6 | Triple Double Gems | Everi | -15 | 3 |

| 7 | NBA Super Slam | FanDuel Studios | -15 | 4 |

| 8 | Might Of Olympus Cashlink | IGT | -14 | 8 |

| 9 | 5 Amazon Jewels | Atomic Slot Lab | -13 | 7 |

| 10 | Gold Standard Jackpots | Everi | -13 | 5 |

Top Ten New Launches

This table shows the top ten most impactful game launches last week.

| Rank | Game Name | Studio | States Launched In | States | Brands Launched On | Brands | Avg Daily Score | Date Launched |

| 1 | Wheel Of Fortune Diamond Spins 2X Wilds | IGT | CT, MI, NJ, PA | 4 | BetMGM PA, BetRivers MI, BetRivers PA, Caesars NJ, FanDuel MI, FanDuel PA, Hollywood MI, Mohegan CT | 8 | 91 | 2025-10-30 |

| 2 | Paddy 2 O Plunder | Atomic Slot Lab | MI, NJ, PA | 3 | Caesars MI, Caesars NJ, FanDuel MI, FanDuel NJ, FanDuel PA, HardRock NJ | 6 | 79 | 2025-10-31 |

| 3 | Ba Fang Jin Bao Abundant Fortune | Konami | MI, NJ, PA | 3 | Caesars MI, Caesars NJ, Caesars PA, FanDuel MI, FanDuel NJ, FanDuel PA | 6 | 68 | 2025-10-31 |

| 4 | Pompeii | Aristocrat | MI, NJ, PA | 3 | Caesars MI, Caesars NJ, Caesars PA, FanDuel MI, FanDuel NJ, FanDuel PA, Golden Nugget NJ, Hard Rock NJ | 8 | 66 | 2025-10-31 |

| 5 | Whirl Win | Bragg Gaming | NJ, PA | 2 | BetMGM NJ, BetMGM PA, Borgata NJ | 3 | 66 | 2025-10-31 |

| 6 | Ba Fang Jin Bao Fortune Totems | Konami | MI, NJ, PA | 3 | FanDuel MI, FanDuel NJ, FanDuel PA | 3 | 54 | 2025-10-31 |

| 7 | Burn In Hell Hold & Win | Prospect Gaming | MI | 1 | BetRivers MI, Caesars MI, FanDuel MI | 3 | 41 | 2025-10-31 |

| 8 | Lucky Luchadoras | Greentube | MI, NJ | 2 | Caesars MI, Caesars NJ, FanDuel MI, FanDuel NJ, Golden Nugget NJ | 5 | 37 | 2025-10-29 |

| 9 | 7S Fire Blitz Hotstepper Power Play | White Hat Studios | CT, MI, NJ, PA | 4 | DraftKings CT, DraftKings MI, DraftKings NJ, DraftKings PA | 4 | 35 | 2025-10-27 |

| 10 | Multi-Rise Video Poker High Roller | IGT | MI, PA | 2 | FanDuel MI, FanDuel PA | 2 | 29 | 2025-10-28 |

Top Studio Best Launches

This table shows the most impactful launches from the studios that ended up in the top ten by the end of our report.

| Rank | Studio | Game Name | Avg Daily Score | Brands | Brands Launched On | Date Launched |

| 1 | IGT | Wheel Of Fortune Diamond Spins 2X Wilds | 91 | 8 | BetMGM PA, BetRivers MI, BetRivers PA, Caesars NJ, FanDuel PA, Hollywood MI, Mohegan CT | 2025-10-30 |

| 2 | White Hat Studios | 7S Fire Blitz Hotstepper Power Play | 35 | 4 | DraftKings CT, DraftKings MI, DraftKings NJ, DraftKings PA | 2025-10-27 |

| 3 | Evolution | Trick Of The Dead Wild Candies Megaways | 11 | 1 | FanDuel NJ | 2025-10-28 |

| 4 | Light & Wonder | Chilli Chomp Ultra Up | 11 | 3 | BetRivers MI, BetRivers PA, Hollywood MI | 2025-10-30 |

| 5 | AGS | No new launches detected | ||||

| 6 | DraftKings Studios | No new launches detected | ||||

| 7 | FanDuel Studios | No new launches detected | ||||

| 8 | Games Global | No new launches detected | ||||

| 9 | Gaming Realms | No new launches detected | ||||

| 10 | Inspired | No new launches detected |

EXPERIMENTAL: Studio and Operator Affinities

This is a new, experimental feature to understand how close studios and operators are – not which games scored highest (that’s above). We’re looking at the strength of the relationships over a three month period, signalled by three things:

- Early exclusive new launches — how often a studio gets the first slot on a single operator. If it’s exclusively live for at least a week we count it.

- How long the average exclusivity period is for that operator/studio combination — the typical days before a second operator picks the title up.

- Still exclusive titles — games that remain single-operator over time.

We roll these into a simple Affinity Score so you can quickly see which partnerships are most active and durable. To keep the signal clean, we exclude in-house studios. Where an operator runs a third party brand (like Borgata with BetMGM in New Jersey) we treat them as a single operator.

This is a guide to closeness of relationship, not outright game Content Positioning Performance – you can get that above! The ranking is deliberately opinionated (weights are transparent and adjustable – see the table below for more details).

| Exclusive Period Launches | Single Operator Launches | Fast Distributing Games |

| 13% | 53% | 34% |

| 75 detected game launches | 299 detected game launches | 194 detected game launches |

| Games we saw go live with one operator for at least a week, and then get more broadly distributed | Game launches that have remained live with only one operator since launching in our 3 month window | Games that got live with more than one operator in a week |

Studio Operator Affinities

Top operator–studio partnerships, ranked by our “Affinity Score” — a measure of how tight those relationships look based on early launches and exclusivity.

| Rank | Operator Name | Studio Name | Early Launch | Still Exclusive | Avg Exclusive Period | Standout Title | Affinity Score |

| 1 | DraftKings | IGT | 7 | 14 | 64 | Big Bank Breakout Cash Eruption | 6.88 |

| 2 | Hard Rock | RubyPlay | 3 | 19 | 71 | J Mania 3 Buffalo | 5.63 |

| 3 | Hard Rock | White Hat Studios | 3 | 13 | 68 | Masters Of Atlantis | 4.46 |

| 4 | DraftKings | Games Global | 4 | 8 | 64 | Kingfisher Rising | 4.01 |

| 5 | BetMGM | Games Global | 4 | 7 | 33 | The Price Is Right Gold Blitz Ultimate | 3.82 |

| 6 | DraftKings | Gaming Realms | 2 | 12 | 39 | Slingo Xxxtreme | 3.72 |

| 7 | FanDuel | RubyPlay | 3 | 6 | 41 | Giga Match Phantasmal | 3.06 |

| 8 | DraftKings | Playtech | 4 | 3 | 70 | Piggies And The Bank Cash Collect & Link | 3.01 |

| 9 | Caesars | Spinomenal | 2 | 8 | 74 | Majestic Claws | 2.90 |

| 10 | Hard Rock | Evolution | 2 | 6 | 57 | Pandora’s Treasure | 2.48 |

| 11 | DraftKings | Evolution | 3 | 3 | 57 | Bonanza Tapcards | 2.46 |

| 12 | FanDuel | Light & Wonder | 1 | 8 | 45 | Huff n Lots Of Puff | 2.37 |

| 13 | BetFanatics | Evolution | 2 | 5 | 61 | Dead Or Alive | 2.27 |

| 14 | FanDuel | Aristocrat | 3 | 1 | 70 | Bao Zhu Zhao Fu Red Festival | 2.06 |

| 15 | Mohegan PA | Evolution | 0 | 10 | 0 | Jingle Spin | 2.02 |

| 16 | FanDuel | Games Global | 2 | 3 | 48 | Triple Phoenix Power Combo | 1.92 |

| 17 | FanDuel | Playtech | 2 | 3 | 34 | Oink Oink Oink Football | 1.91 |

| 18 | DraftKings | Light & Wonder | 2 | 3 | 72 | Hypercharged Pyramids Of Ra | 1.90 |

| 19 | Hard Rock | Relax Gaming | 0 | 9 | 0 | Bill & Coin | 1.86 |

| 20 | Caesars | High 5 Games | 1 | 5 | 54 | Green Machine Deluxe Jackpot | 1.74 |

Affinity is designed to surface relationship strength, not just high-scoring games. We combine three signals:

- Early Launch — how many titles a studio launched with an operator at least 31 days before appearing anywhere else

- Still Exclusive — how many titles are still single-operator after 31+ days

- Avg Exclusive Period — for titles that did expand, the average days they remained exclusive before a second operator picked them up (fast movers count less; long windows count more)

These inputs are blended into a single Affinity Score (weighted to favour more early launches, some credit for always-exclusive titles, and a smaller boost for longer exclusive windows). We exclude in-house studios so you’re seeing competitive partnerships only. “Top exclusive title” highlights the strongest recent example by CPS (our region-weighted Content Positioning Score) to give each row a recognizable anchor.

Slot Index is the brainchild of Product Radars, founded by industry veterans Dominic Le Garsmeur and Steve Schrier.