Gaming Intelligence presents the Brazil Slot Intel report from Product Radars for the week ended October 25th, ranking the most popular games in Brazil’s regulated iGaming market.

Reporting Period: 19/10/2025 – 25/10/2025

The Product Radars Rankings accounts for lobby position and estimated market share across the top 20 regulated sites in Brazil.

Where studios have more than one studio brand we collapse all of those numbers under the main studio. For example Evolution statistics contains all Big Time Gaming, NoLimit City, NetEnt and Red Tiger Games.

Here’s what you need to know:

📊 Market share reshuffle – We’ve updated our operator weighting model this month, revealing some major shifts. Betano remains the market leader, but their share slips from 24.8 → 19.4%. 7Games more than doubles its estimated share to 11.0%, leading a strong wave of challengers.

🔥 Pragmatic Play back on top – A week after losing out to PG Soft, they reclaim first place by the thinnest of margins, helped by their unmatched depth across brands (10 titles in the Top 20).

🐉 PG Soft right behind – The Fortune family continues to dominate, with Fortune Tiger and Fortune Rabbit both climbing more than 40 points week-on-week.

💎 Newcomers rising fast – Brands like Hiperbet, Afun, and Vera enter the Top 20, while Hot Gems Cash Collect (Playtech) and 7 Sensational Wins (Synot) shine as top new launches.

| Unique Games: 664 | Unique Studios: 81 | Unique Titles: 6,048 | Game Launches: 38 |

| Unique games detected in last week | Unique studios detected in last week | Unique game titles detected in last week | New game launches detected in last week |

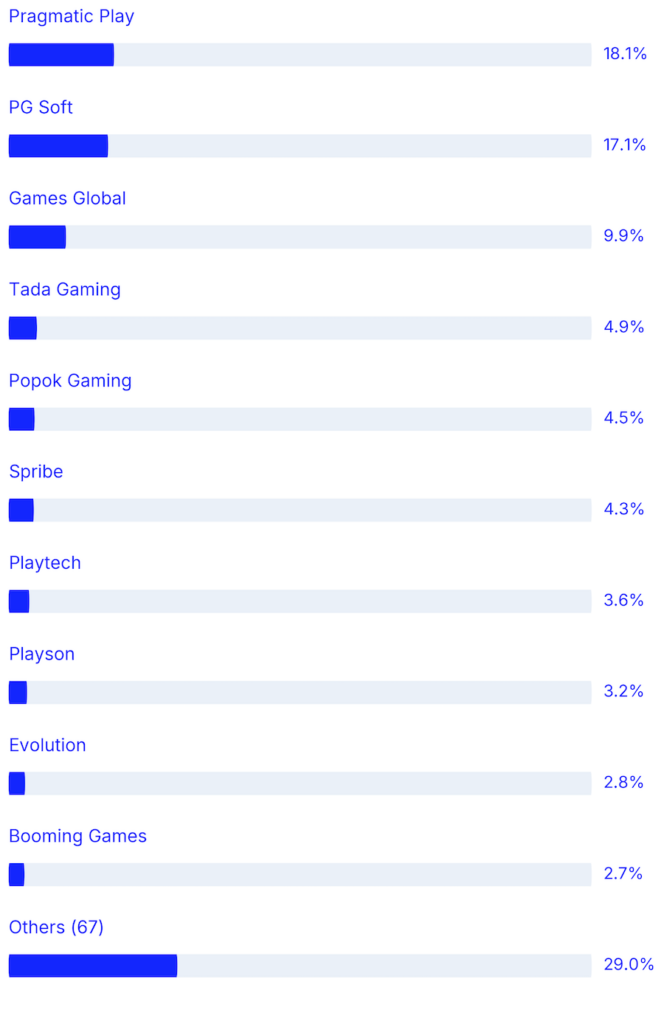

Studio Weekly Share

This chart shows the share a studio has of game positions. The algorithm accounts for the position of the game on each page, giving a higher share value to games on the top left and games in featured game slots. It also accounts for our estimated Brazilian market share of each operators site, so a game top left on a site like Betano will score highly.

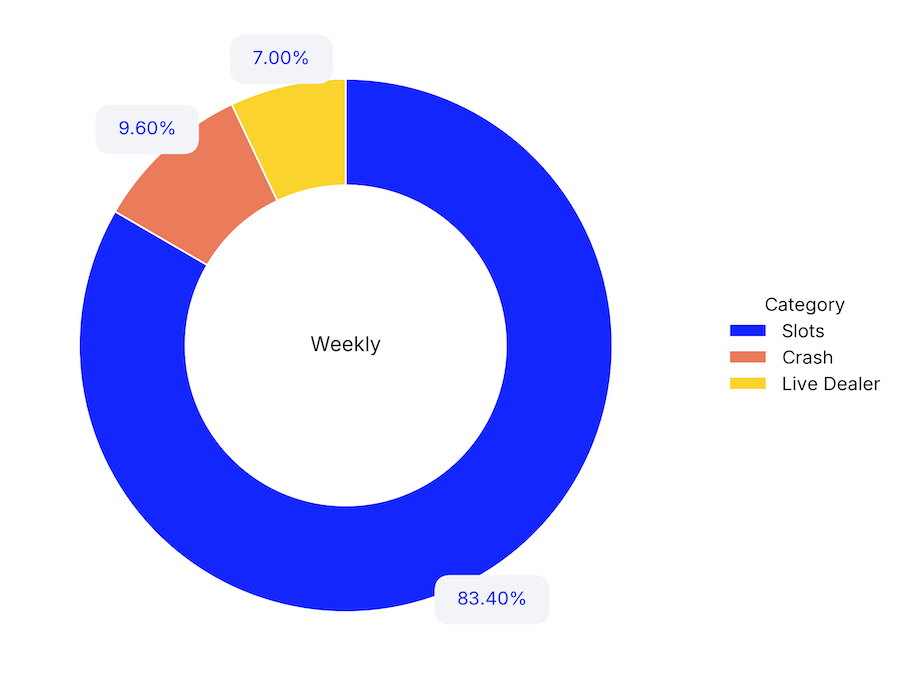

Content Type Positioning Split

This chart shows the content positioning share between Crash Games, Slots and Live Dealer. This is not the same as GGR split. We estimate that Live Dealer and Crash Game GGR share is substantially higher than shown here in GGR.

Operator Highlights

Our latest market share propriatary research brings a noticeable shift in the landscape. Betano remains the clear market leader, but their once-commanding share has slipped from 24.8% to 19.4%, as competitors continue to chip away at the top spot. Their scale still sets the benchmark, yet the margin above the chasing pack is narrower than at any point in the second half of this year.

The big story, however, is the rise of 7Games, which more than doubles its estimated share to 11.0% (up from 5.7%). The brand’s growth momentum is unmistakable – their marketing and content strategies have clearly paid off. Superbet and Betao also hold firm in the top tier, together accounting for nearly 18% of total traffic, while the arrival of Hiperbet, Afun, and Vera injects fresh competition into the mid-market.

At the same time, several legacy brands drop out of the top 20 – including 9D, Bet.app, Betesporte, Blaze, H2 Bet, Novibet, and P9 – marking the end of a cycle that saw many early entrants lose visibility to faster-moving newcomers.

Top 20 Games

| Rank | Game Name | Studio | Score | Unique Brands |

| 1 | Fortune Tiger | PG Soft | 691 | 20 |

| 2 | Aviator | Spribe | 689 | 17 |

| 3 | Fortune Rabbit | PG Soft | 677 | 20 |

| 4 | Fortune Dragon | PG Soft | 592 | 18 |

| 5 | Fortune Ox | PG Soft | 426 | 18 |

| 6 | Area Link Phoenix Firestorm | Games Global | 286 | 9 |

| 7 | Tigre Sortudo | Pragmatic Play | 246 | 11 |

| 8 | Touro Sortudo | Pragmatic Play | 225 | 10 |

| 9 | Gates Of Olympus Super Scatter | Pragmatic Play | 201 | 10 |

| 10 | Spaceman | Pragmatic Play | 199 | 10 |

| 11 | JetX | Smartsoft Gaming | 183 | 12 |

| 12 | High Flyer | Pragmatic Play | 179 | 9 |

| 13 | Gates Of Olympus | Pragmatic Play | 174 | 12 |

| 14 | Double Fortune | PG Soft | 165 | 4 |

| 15 | Tigre Sortudo 1000 | Pragmatic Play | 160 | 6 |

| 16 | Big Bass Halloween 3 | Pragmatic Play | 157 | 8 |

| 17 | Ratinho Sortudo | Pragmatic Play | 151 | 6 |

| 18 | Diamonds Power Hold And Win | Playson | 149 | 3 |

| 19 | Cachorro Sortudo | Pragmatic Play | 147 | 6 |

| 20 | Fortune Mouse | PG Soft | 146 | 11 |

Top Movers Up

| Rank | Game Name | Studio | Score Δ | Brands |

| 1 | Aviator | Spribe | +41 | 17 |

| 2 | Fortune Rabbit | PG Soft | +41 | 20 |

| 3 | Fortune Tiger | PG Soft | +31 | 20 |

| 4 | Double Fortune | PG Soft | +25 | 4 |

| 5 | Fortune Dragon | PG Soft | +24 | 18 |

| 6 | Burning Fortunator | Playson | +24 | 2 |

| 7 | Fortune Ox | PG Soft | +23 | 18 |

| 8 | 4 Fantastic Fish Amazon Adventure | 4 The Player | +21 | 1 |

| 9 | Roda Da Sorte | Betano | +20 | 1 |

| 10 | Acelera Betano | _ | +20 | 1 |

Top Movers Down

| Rank | Game Name | Studio | Score Δ | Brands |

| 1 | Oink Oink Oink | Playtech | -16 | 2 |

| 2 | Wanted Dead Or A Wild | Hacksaw | -16 | 1 |

| 3 | Crazy Monkey Banana Kingdom | Games Global | -12 | 2 |

| 4 | Tigre Sortudo | Pragmatic Play | -12 | 11 |

| 5 | Panda Luck | B Gaming | -11 | 1 |

| 6 | Feed The Fish | CR Games | -9 | 1 |

| 7 | Fortune Gems 500 | Tada Gaming | -9 | 3 |

| 8 | Double Max | Banana Games | -8 | 2 |

| 9 | Onça Sortuda | Tada Gaming | -8 | 1 |

| 10 | Hot As Hades Power Combo | Games Global | -8 | 3 |

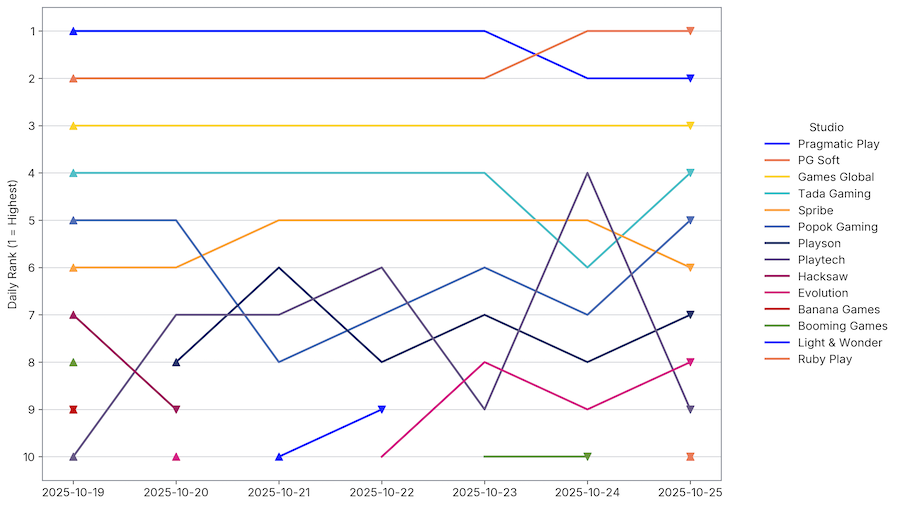

Daily Studio Rankings

It’s all change this week as our new operator market share data impacts the charts.

- Pragmatic Play get first place, turning a 0.4% deficit into a 1% lead over PG Soft for the week. Their distribution across brands combined with the depth of their portfolio (10 games in the top 20) just about sees them win out the week, but it’s tight and they do slip to second on our daily rankings by Friday.

- PG Soft are right behind them. They have great coverage on 7Games (along with PopOK), who’ve grabbed a 5% market share increase. If their growth continues expect PG Soft to benefit.

- Games Global steadied its position at third, bolstered by Area Link Phoenix Firestorm, which gained traction across nine brands on 19th October. Space Haul Inc. launches well.

- Below our top three it stays competitive. Tada Gaming and PopOK are fighting it out for 4th place. Tada have the edge at the moment, but there’s only half a percent in it so all to play for. Their new launch Crown Of Fortune went live on the last day of our report so we’ll get a real view on its performance next week (and we’ll see if it is exclusive to Novibet or distributes more widely).

- Playtech get our (joint place) launch of the week with Hot Gems Cash Collect and their overall share edges up as they continue to make inroads into the Brazilian market.

- It’s worth having a closer look at Playson. They are 8th in out chart, and have some strong daily performances. Diamonds Power Hold And Win is crashing the top 20, sitting comfortably among titles we’ve been looking at most of the year. Burning Fortunator is a strong riser too.

Ones to watch:

- Synot and Spinberry are the other two studios to share the best launches top spot with 7 Sensational Wins and Symbols Of Success respectively. Spinberry also had a good launch with Piggy Bank Fortune. Excellent week for them.

Top Studio Best Launches

This new table shows the most impactful launches from the studios that ended up in the top ten by the end of our report.

| Rank | Studio | Game Name | Avg Daily Score | Brands | Brands Launched On | Date Launched |

| 1 | Playtech | Hot Gems Cash Collect | 12 | 1 | Betano | 2025-10-25 |

| 2 | Games Global | Space Haul Inc. | 11 | 1 | Betano | 2025-10-23 |

| 3 | Evolution | Play With The Devil | 7 | 2 | Sportingbet, Superbet | 2025-10-25 |

| 4 | Pragmatic Play | Hot To Burn | 2 | 1 | Estrelabet | 2025-10-23 |

| 5 | Tada Gaming | Crown Of Fortune | 1 | 1 | Novibet | 2025-10-25 |

| 6 | Booming Games | — | 0 | 0 | — | — |

| 7 | PG Soft | — | 0 | 0 | — | — |

| 8 | Playson | — | 0 | 0 | — | — |

| 9 | PopOK Gaming | — | 0 | 0 | — | — |

| 10 | Spribe | — | 0 | 0 | — | — |

This Week’s Top Launches

| Rank | Game Name | Studio | Brands Launched On | Brands | Avg Daily Score | Date Launched |

| 1 | 7 Sensational Wins | Synot | Betano | 1 | 12 | 2025-10-25 |

| 2 | Hot Gems Cash Collect | Playtech | Betano | 1 | 12 | 2025-10-25 |

| 3 | Symbols Of Success | Spinberry | Betano | 1 | 12 | 2025-10-25 |

| 4 | Immortal Ways Magic Gems | RubyPlay | Betano | 1 | 11 | 2025-10-24 |

| 5 | Lawn n Disorder | Play’n GO | Betano | 1 | 11 | 2025-10-25 |

| 6 | Piggy Bank Fortune | Spinberry | Betano | 1 | 11 | 2025-10-25 |

| 7 | Space Haul Inc. | Games Global | Betano | 1 | 11 | 2025-10-23 |

| 8 | Play With The Devil | Evolution | Sportingbet, Superbet | 2 | 7 | 2025-10-25 |

| 9 | Cathedral | Light & Wonder | bet365, Novibet | 2 | 6 | 2025-10-25 |

| 10 | Bonanza Blast | AGS | bet365 | 1 | 5 | 2025-10-25 |

| 11 | Sugar Monster | Evolution | Superbet | 1 | 5 | 2025-10-22 |

| 12 | Crazy Tiki Hold & Win | Iron Dog Studio | Novibet, Superbet | 2 | 4 | 2025-10-23 |

| 13 | Free The Dragon | Playtech | bet365 | 1 | 4 | 2025-10-23 |

| 14 | Happy Bamboo | Push Gaming | bet365 | 1 | 4 | 2025-10-23 |

| 15 | Phoenix Star | Amusnet | Superbet | 1 | 4 | 2025-10-23 |

Slot Index is the brainchild of Product Radars, founded by industry veterans Dominic Le Garsmeur and Steve Schrier.