The ‘Mob model’ that has served Las Vegas so well for so long is dead. An offer of cheap rooms, drinks and entertainment in exchange for gaming floor losses has been replaced by one in which the customer pays top dollar for everything.

In 2025, the average daily room rate across Las Vegas is $181 but a visitor wanting to stay on the Strip can expect to pay more than twice that. At most leading hotels there will also be an additional daily resort fee of $50, which covers services like internet access and use of the fitness centre. If a guest requires car parking at the resort, the daily charge is between $20 and $40. In some hotels guests might even be charged $50 for placing their own items in the mini-bar.

Prices for food and drink have also been rising in Las Vegas, from fast food to fine dining. At Caesars Palace, a pepperoni pizza from DiFara Pizza cost $52.99 in 2023 and a single slice was $9.99.

In 2025, the Buddy V’s Pizzeria which replaced DiFara charges $11.99 for a slice and $59.99 for a whole pie. The cost of a slice of pizza at Caesars Palace has risen by 20 per cent in two years.

The casinos in Las Vegas were able to get away with price hikes and charges in the immediate aftermath of the pandemic. People were looking to enjoy themselves following a period of restricted travel and they had money to spend because of almost two years of curtailed entertainment options. Now, however, tourists are beginning to stay away.

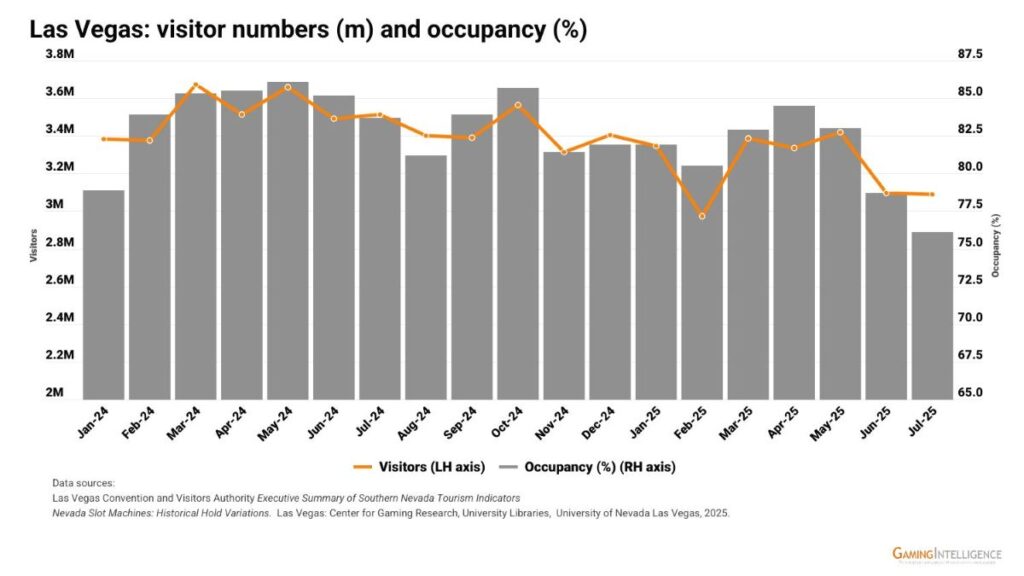

Visitor numbers to Las Vegas have been dropping in 2025. For July, there were 3.09 million visitors, a total which was 12 per cent down on July 2024. In the first seven months of 2025, visitor numbers are down by 8 per cent to 22.64 million.

Las Vegas’ hotel occupancy for July was 76.1 per cent, 7.6 percentage points lower than the same month of 2024. June’s occupancy rate was also below 80 per cent at 78.7 per cent.

The decline in visitors to Las Vegas is at odds with Nevada’s gambling revenue, which is at record levels.

Annual gaming revenue in Nevada was at its highest in 2024 at $15.61 billion, beating the previous record set in 2023. Nevada’s gaming revenue in H1 2025 was the state’s best first half performance at $7.79 billion.

But gaming’s share of Nevada’s overall revenue has been declining. It fell below 50 per cent in 2005 and, despite a spike of 58 per cent in 2021, is now around 43 per cent of revenue.

Rooms have been accounting for an increasing share of Nevada’s revenue and hit 24 per cent for the first time in 2023 and were at almost 25 per cent in 2024.

On the Las Vegas Strip, rooms accounted for 30 per cent of revenue last year, a new high, and not far behind gaming on 35 per cent.

As well as rising total accommodation costs, casual gamblers are also being squeezed by the casinos on the gaming floor.

Minimum bet levels are being raised and at the remaining lower staking tables the payout is often worse. Some gaming floors offer roulette wheels with triple zeros, increasing the house edge, and there are blackjack tables paying 6 to 5 rather than 3 to 2 for a natural 21.

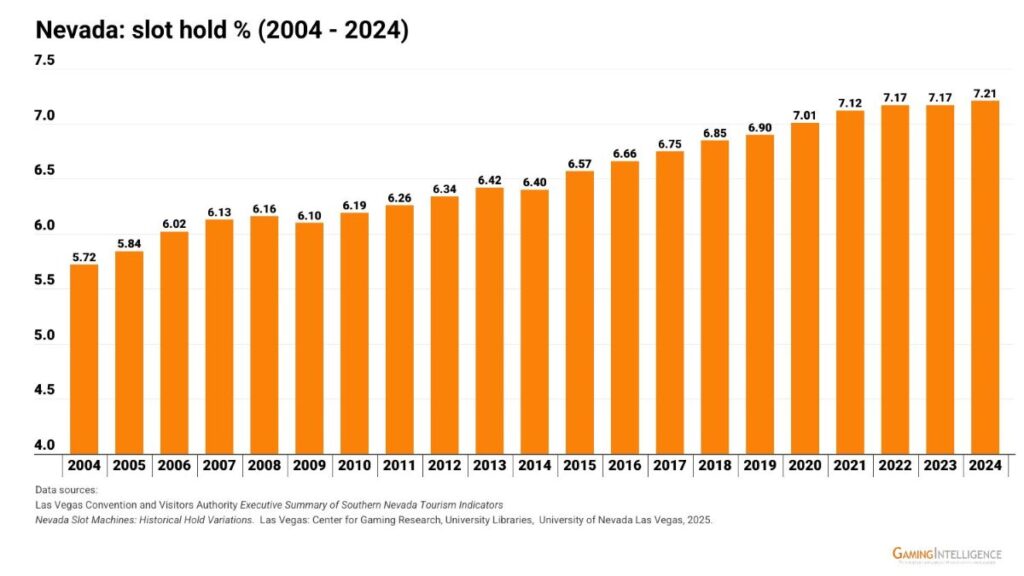

Slot machines earn the bulk of the casinos’ gaming revenue and the hold percentage they achieve has been steadily increasing. Revenue from Nevada’s 127,176 slot machines was 67 per cent of gaming revenue in 2024 at $10.52 billion.

The statewide hold percentage from slots was 7.21 per cent in the year, the highest level in the last 20 years. 2024’s hold percentage was up by 4 per cent on 2019 and by 26 per cent on 2004’s hold rate.

On last year’s data, every 0.1 percentage point increase in slot hold is worth $145 million in revenue across the sector, and a higher margin is easier to hide from players on machines than at the gaming tables.

The casino operators are subject to inflationary pressures just like any sector. But Las Vegas is perhaps hit harder because it has previously been perceived, rightly or wrongly, to be a place of subsidised or ‘comped’ entertainment.

Several casino groups have also sold their real estate in recent years on ‘sale and lease back’ deals to free up cash. As a result, VICI Properties is possibly the biggest landlord on the Strip and owns venues such as the MGM Grand, Mandalay Bay, Caesars Palace and The Venetian. Casino operators are now tenants with rent to pay in casinos they previously owned, so it is no surprise that there has been a change in their business model.

The casinos could, of course, dig up the old business model, if they wanted. But, as it stands, in 2025 “what happens in Vegas, stays in Vegas” and costs a lot!