Since January 2020 PENN Entertainment has committed itself to more than $4.5 billion in acquisitions and partnerships in the North American sports betting sector.

The gamble on Barstool didn’t pay off and now the company has bet the house on its deal with ESPN. With PENN’s share price languishing at post-pandemic lows, shareholders will want the launch of ESPN BET to start bringing a return on all of that spending.

Under the 10-year strategic alliance with ESPN announced in August 2023, PENN Entertainment will pay ESPN $150 million per year and give ESPN $500 million in up-front warrants for PENN equity. In return, PENN has the exclusive right to use the ESPN BET trademark and benefits from the integration of the brand throughout ESPN’s sports media ecosystem.

The launch of ESPN BET in November 2023 meant PENN tore up the betting slip on its Barstool Sports brand. PENN paid a total of $551 million for Barstool, including $388 million in February 2023, just six months before the ESPN deal. At the same time as the ESPN deal was announced, Barstool was sold back to its founder David Portnoy for $1, a non-compete agreement, and 50 per cent of any future sale or ‘monetisation event’.

PENN booked an overall loss of $923 million on the disposal of Barstool in 2023. Writing off that amount of money does put pressure on PENN to make a success of the ESPN partnership. That pressure was exacerbated just after the end of Super Bowl LVIII, when Barstool announced a multi-year deal to be DraftKings’s exclusive betting partner. If ESPN BET is to succeed in the US, DraftKings is one of the main rivals from which it will have to take market share.

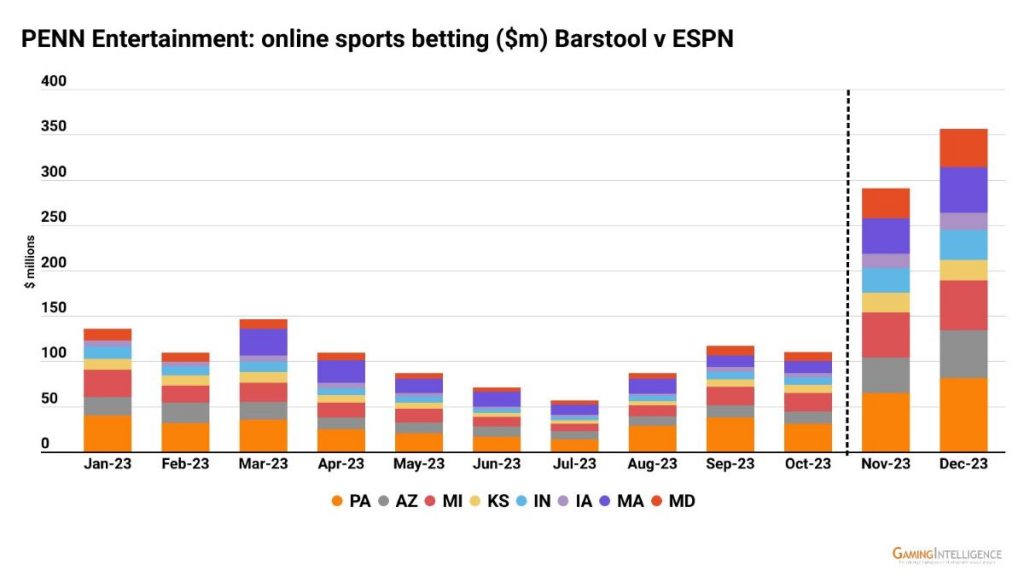

The first months of online sports betting looked good under ESPN BET when it launched in November. Across a sample of eight states, handle jumped from $110 million in October to $291 million in November and then to $356 million in December, and comfortably beat the best months under the Barstool brand in 2023.

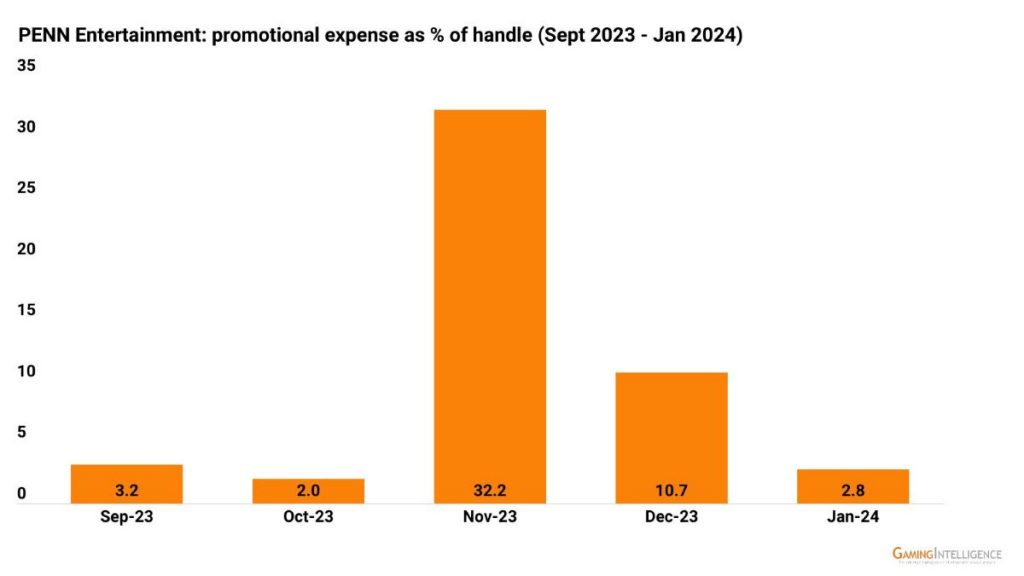

But PENN did spend a lot of money to earn that increased handle. In November, PENN reported that promotional expenses represented 32 per cent of its handle, up from just 2 per cent in October. The figure for December was 11 per cent and back down to 3 per cent in January.

Chief Executive Jay Snowden explained that ESPN BET had attracted ‘significantly more’ first-time depositors (FTDs) than expected, which increased the promotional expenses during the months after launch.

Snowden stated, “The November 14th launch of ESPN BET led to tremendous download volumes, conversion to over 1 million FTDs, and record handle, supported by our partners at ESPN and our proprietary technology”.

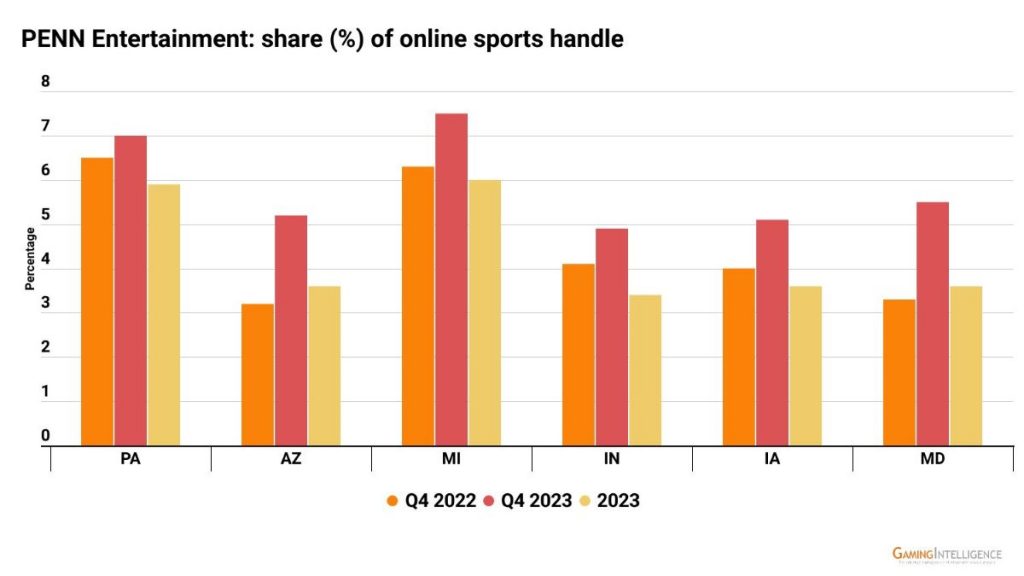

There was a small but definite increase in PENN’s market share in the fourth quarter of 2023 compared with the previous year. In Michigan and Pennsylvania, PENN’s share of online sports betting hit 7 per cent in Q4 2023. Its quarterly share in Maryland was up by 2.2 percentage points and by 2 percentage points in Arizona.

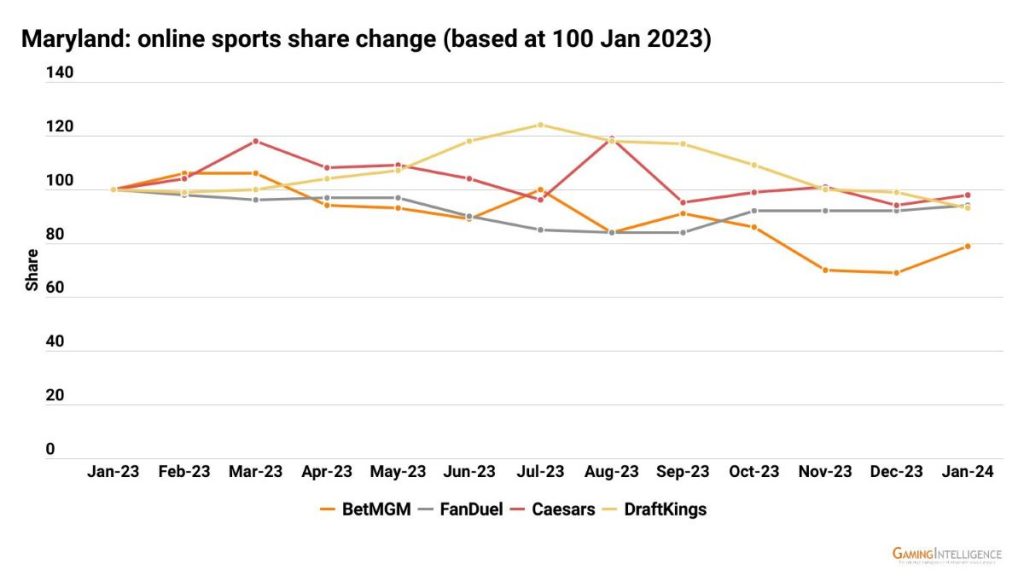

The short time frame since launch and the relatively small increases do make it difficult to assess which other brands lost handle share to ESPN BET. In Maryland, however, there is some evidence that BetMGM lost out to ESPN BET in November and December.

Basing each of the leading brand’s market share to 100 in January 2023 shows that BetMGM’s share dropped to its lowest levels of the year in November and December. This drop coincides with ESPN BET’s launch and its increased promotional spending. Up until October, BetMGM’s monthly share in 2023 had been above 8 per cent, but fell below 7 per cent in November and December.

If this data does show ESPN BET taking share from BetMGM, the concern for PENN should be that BetMGM recovered its share back above 7 per cent in January 2024 when ESPN’s promotional spending reduced.

PENN’s promotional spending in Maryland was $13.0 million in November, $5.8 million in December and $859,657 in January. For its part, BetMGM increased promotional spending from $1.0 million to $2.0 million between December and January.

A marketing war in which fickle customers switch brands depending on which one is offering the best promotions that month will become very expensive and is not sustainable in the long term. In Pennsylvania, PENN spent almost $25 million on promotional sports betting credits between November 2023 and January 2024, but the taxable revenue over that same period was a loss of almost $8 million.

But all the metrics mentioned so far are almost insignificant to the ambitious targets that PENN has for its deal with ESPN in the longer term.

When it announced the partnership, PENN estimated that it could be worth $1 billion in annual adjusted EBITDA by 2027 across sports betting and iGaming.

This forecast assumed that the North American sports betting market would have revenue of $15 billion (including Ontario) and iGaming $14 billion, and that ESPN BET would hold 20 per cent of the former and 16 per cent of the latter.

The company also presented a lower-parameter estimate worth $500 million in EBITDA from a 10 per cent sports betting share and an 8 per cent iGaming share.

The upper-parameter case would require PENN to earn total interactive gambling revenue of $5.2 billion in 2027. This figure is a seven-fold increase on the $719 million that the company reported in interactive revenue for 2023.

In 2023, the US and Ontario interactive gambling sector had revenue of almost $19 billion, giving PENN a market share of 4 per cent. To achieve the potential $1 billion in EBITDA in 2027, that share of revenue needs to rise to 18 per cent.

As well as growth in existing markets over the next few years, ESPN BET will also enter new markets to meet its ambitious goals. North Carolina is one such market in 2024 and PENN has also paid $25 million to acquire Wynn Interactive’s sports betting licence in New York.

The purchase will give PENN access to the largest regulated sports betting market in the United States, but it is also highly-taxed and competitive. FanDuel and DraftKings are well established and held 82 per cent of New York’s mobile betting gross revenue between them in 2023.

By contrast, Wynn Interactive failed to earn enough gross revenue in two years to cover even half the cost of its licence – and that was before it paid 51 per cent of its gross revenue in tax.

ESPN BET can certainly perform a lot better than Wynn in New York and there are several other smaller licensees from which it can take handle share.

Assuming ESPN BET held a 20 per cent share of a total New York market worth $27 billion in handle by 2027 (2023: $19 billion), this would give it handle of $5.4 billion. Applying New York’s 2023 win margin of 8.8 per cent results in $475 million in gross revenue and just $86 million in EBITDA, using PENN’s forecast gross revenue to EBITDA conversion rate of 18 per cent.

Such a level of contribution from a key market like New York places a lot of weight on other states if PENN is to hit its upper EBITDA potential of $1 billion.

New York becomes much more attractive if iGaming regulation is passed in the Empire State with a sensible tax rate. The state’s budget for 2025 includes no assumed tax revenue from iGaming, so by 2027 the iGaming sector would still be in its early stages as a best-case scenario.

New York sports handle conversion: 2027 forecast

| $ million | Assumptions | |

| Handle | 5,400 | 20% share of $27 billion |

| Gross revenue | 475 | 8.8% margin as in 2023 |

| Betting tax | 242 | 51% tax rate |

| After-tax gross revenue | 233 | |

| EBITDA | 86 | 18% conversion rate of gross revenue |

PENN’s reasoning behind the ESPN deal is clear. It has had success in Ontario with ScoreBet, a brand which closely links sports betting with theScore media app and has secured PENN ‘double digit’ market share. PENN has also highlighted the growth of Sky Bet in the UK and its links with Sky Sports. The intention is to replicate this success in the US within the ESPN media ecosystem.

A combination of factors will need to come to fruition to help PENN meet its targets:

- Low customer acquisition costs made possible by ESPN’s existing reach and audience.

- Customer loyalty to the ESPN brand to prevent long-term ‘promotion wars’.

- Further regulation of US iGaming markets – iGaming provides more stable revenue and outperforms sports betting in the states where it is permitted.

- The successful cross-selling of iGaming from within the ESPN ecosystem.

PENN Entertainment’s bet on the ESPN alliance is a big one and, with the company forecasting $400 million in EBITDA losses from its interactive division in 2024, a break-even point in 2025, and profits only beginning to be generated in 2026, it acknowledges there will be no quick pay back.